- Results exceeded all guided metrics

- Second quarter subscription ARR grew 36% year-over-year to $1.25 billion

- Second quarter revenue grew 51% year-over-year to $309.9 million

- 2,505 customers with $100K or more in subscription ARR, up 27% year-over-year

Palo Alto, California, September 9, 2025 – Rubrik, Inc. (NYSE: RBRK), the Security and AI company, today announced financial results for the second quarter of fiscal year 2026, ended July 31, 2025.

"We delivered a strong quarter with exceptional top-line growth and significant cash flow margin. We continue to build towards a highly profitable growth business. We’re also pleased to close the acquisition of Predibase, which bolsters our ability to deliver secure, efficient and accelerated GenAI for our customers. We look forward to continuing to unlock new frontiers in data, security, and AI as we build a generational company,” said Bipul Sinha, Rubrik’s Chief Executive Officer, Chairman, and Co-Founder.

Commenting on the company’s financial results, Kiran Choudary, Rubrik’s Chief Financial Officer, added, “We saw solid results in the second quarter with 36% growth in subscription ARR and a 19% free cash flow margin. This was driven by healthy new customer acquisition, robust expansion and increased efficiencies in the business. We’re pleased to raise our outlook for fiscal 2026.”

Second Quarter Fiscal 2026 Financial Highlights

- Subscription Annual Recurring Revenue (ARR): Subscription ARR was up 36% year-over-year, growing to $1.25 billion as of July 31, 2025.

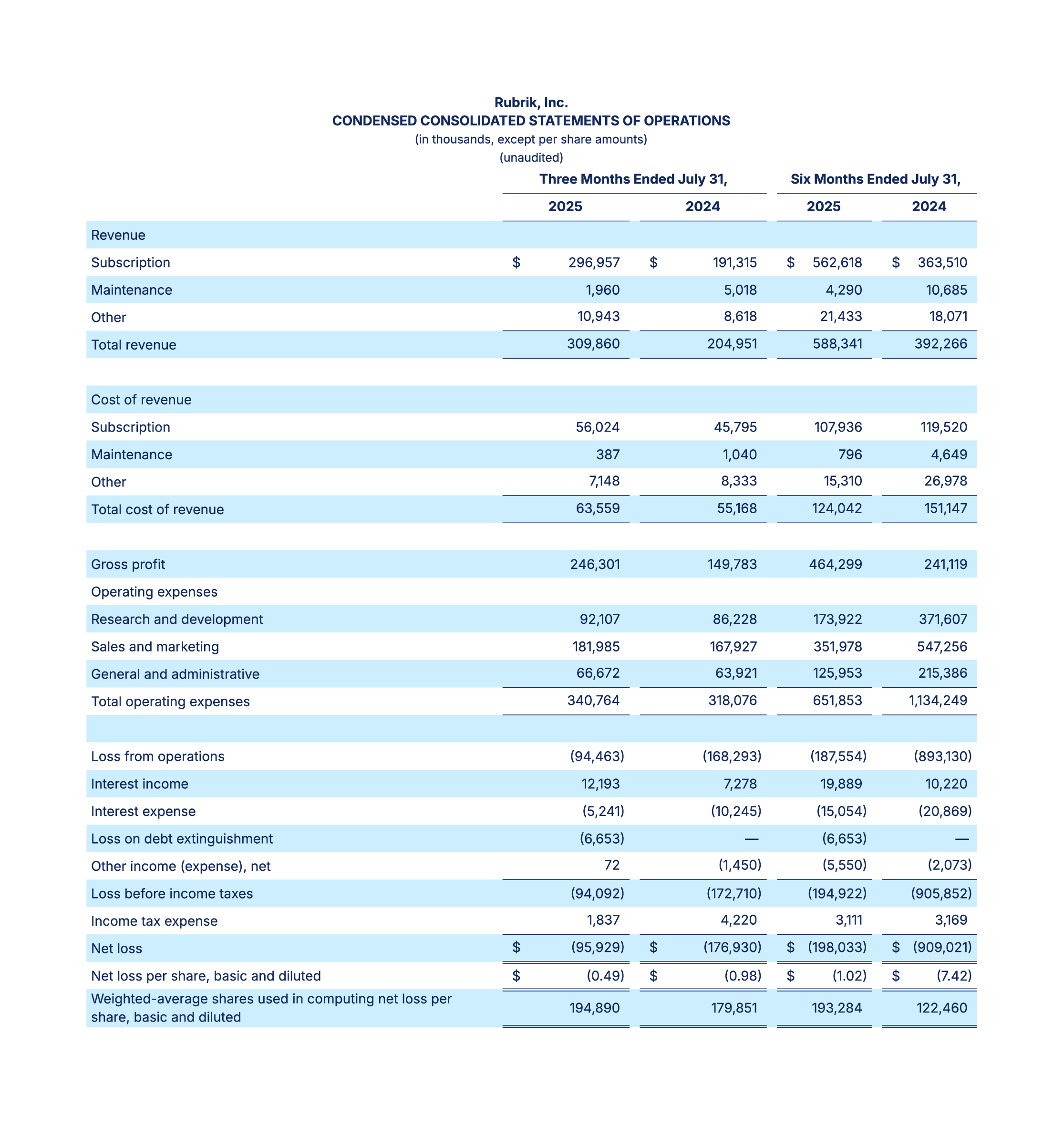

- Revenue: Subscription revenue was $297.0 million, a 55% increase compared to $191.3 million in the second quarter of fiscal 2025. Total revenue was $309.9 million, a 51% increase compared to $205.0 million in the second quarter of fiscal 2025.

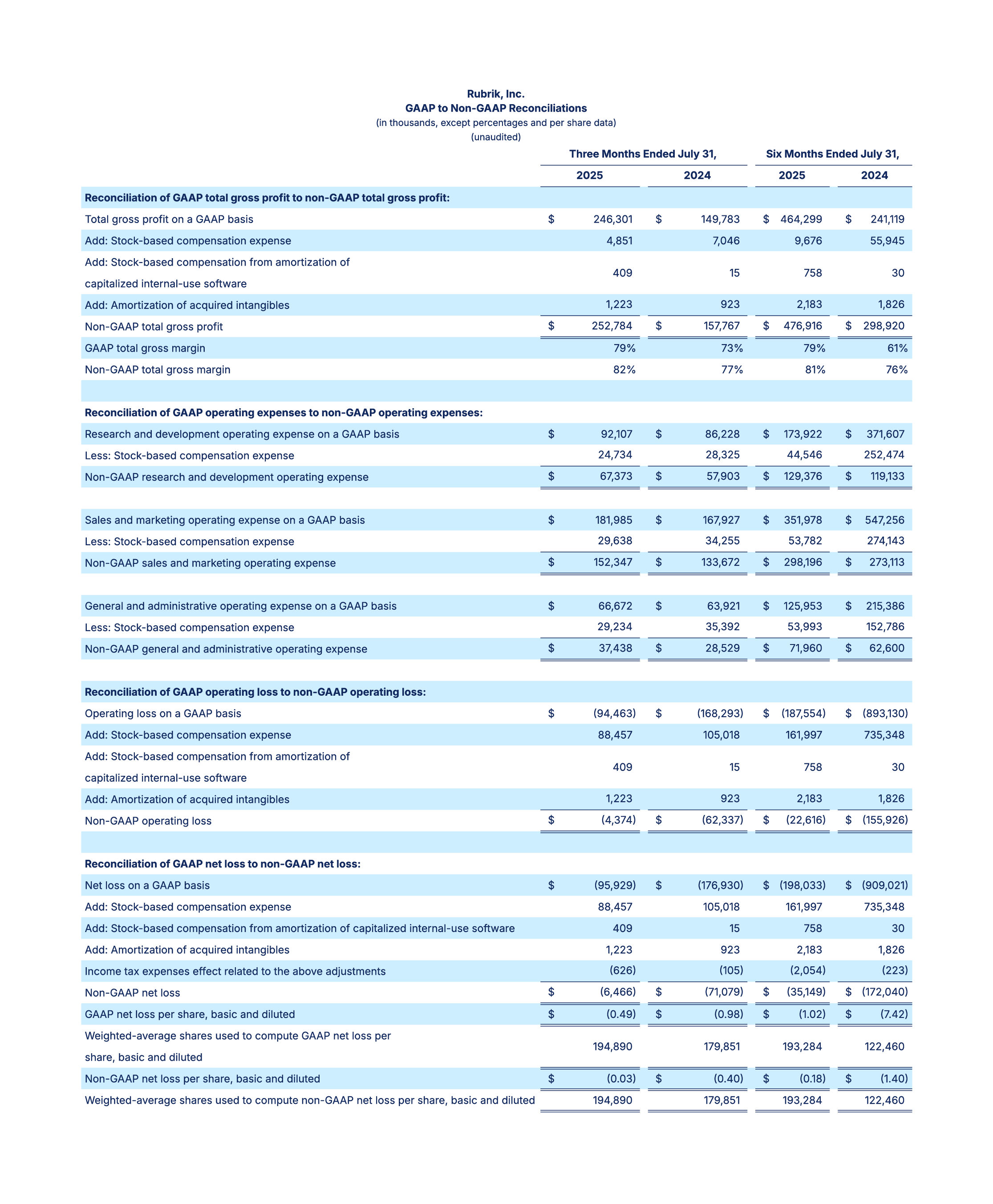

- Gross Margin: GAAP gross margin was 79.5%, compared to 73.1% in the second quarter of fiscal 2025. This includes $4.9 million in stock-based compensation expense, compared to $7.0 million in the second quarter of fiscal 2025. Non-GAAP gross margin was 81.6%, compared to 77.0% in the second quarter of fiscal 2025.

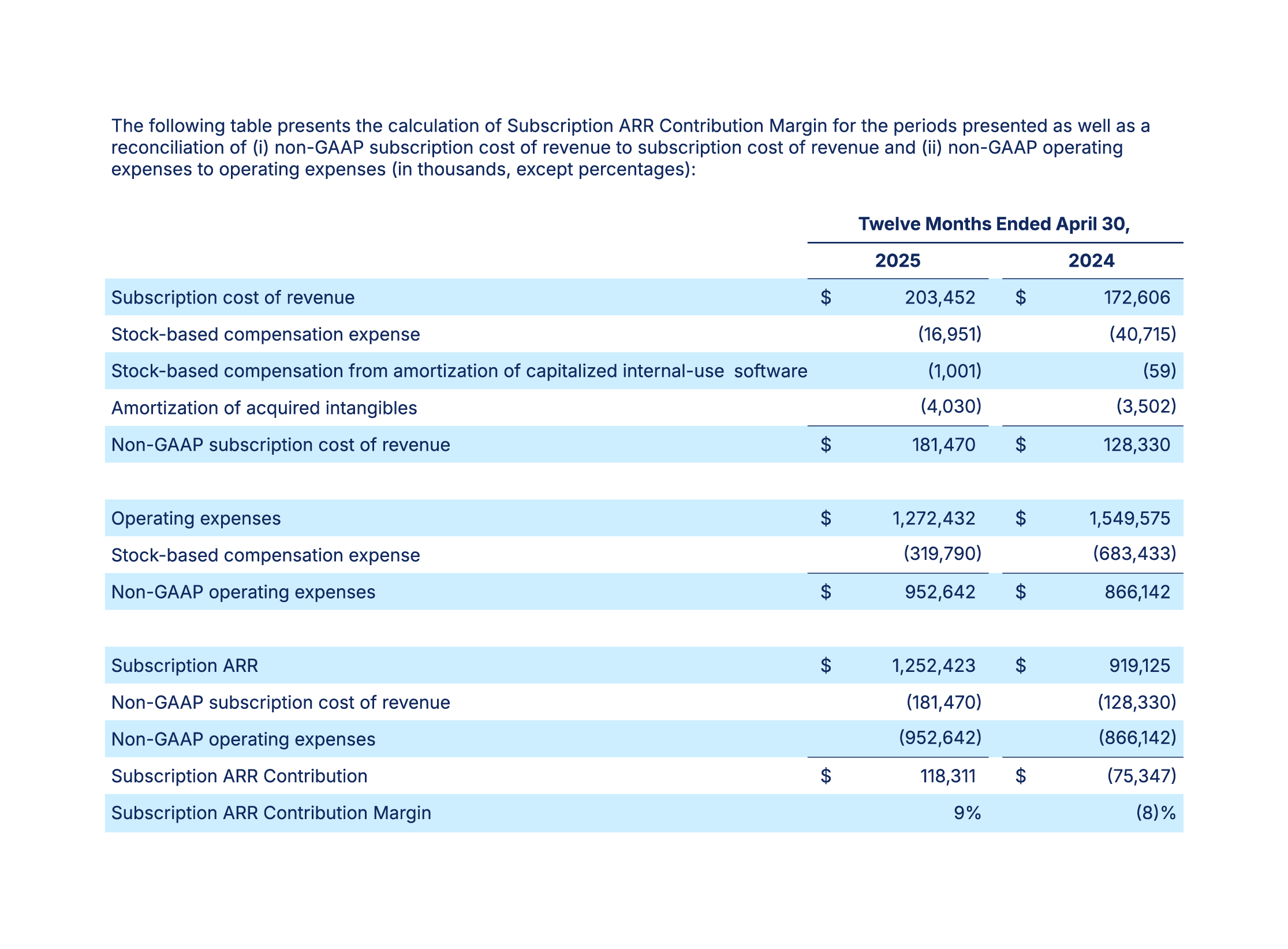

- Subscription ARR Contribution Margin: Subscription ARR contribution margin was 9.4% compared to (8.2)% in the second quarter of fiscal 2025, reflecting the strong net new subscription ARR in the quarter and an improvement in operating leverage in the business.

- Net Loss per Share: GAAP net loss per share was $(0.49), compared to $(0.98) in the second quarter of fiscal 2025. GAAP net loss includes $88.5 million in stock-based compensation expense, compared to $105.0 million in the second quarter of fiscal 2025. Non-GAAP net loss per share was $(0.03), compared to $(0.40) in the second quarter of fiscal 2025.

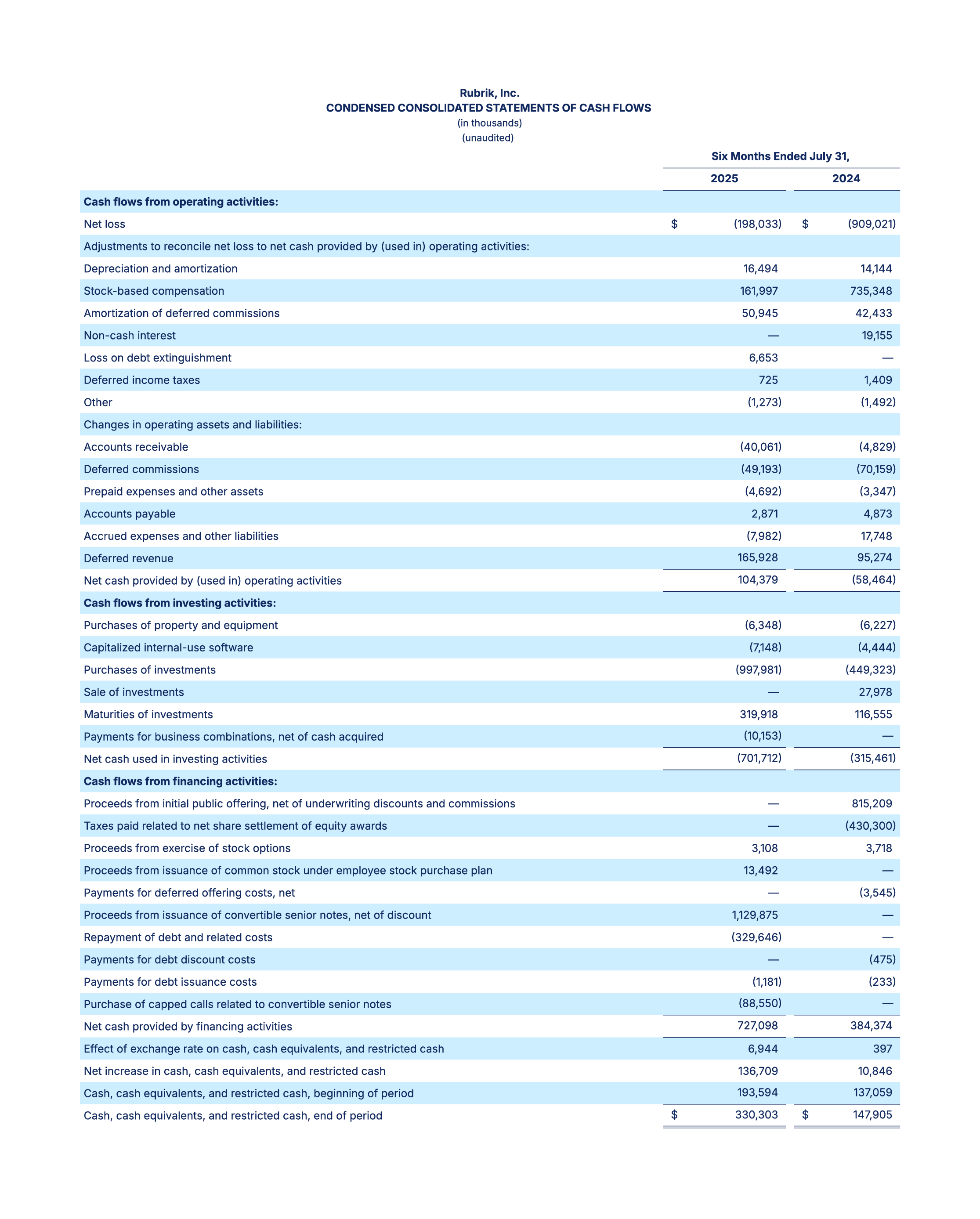

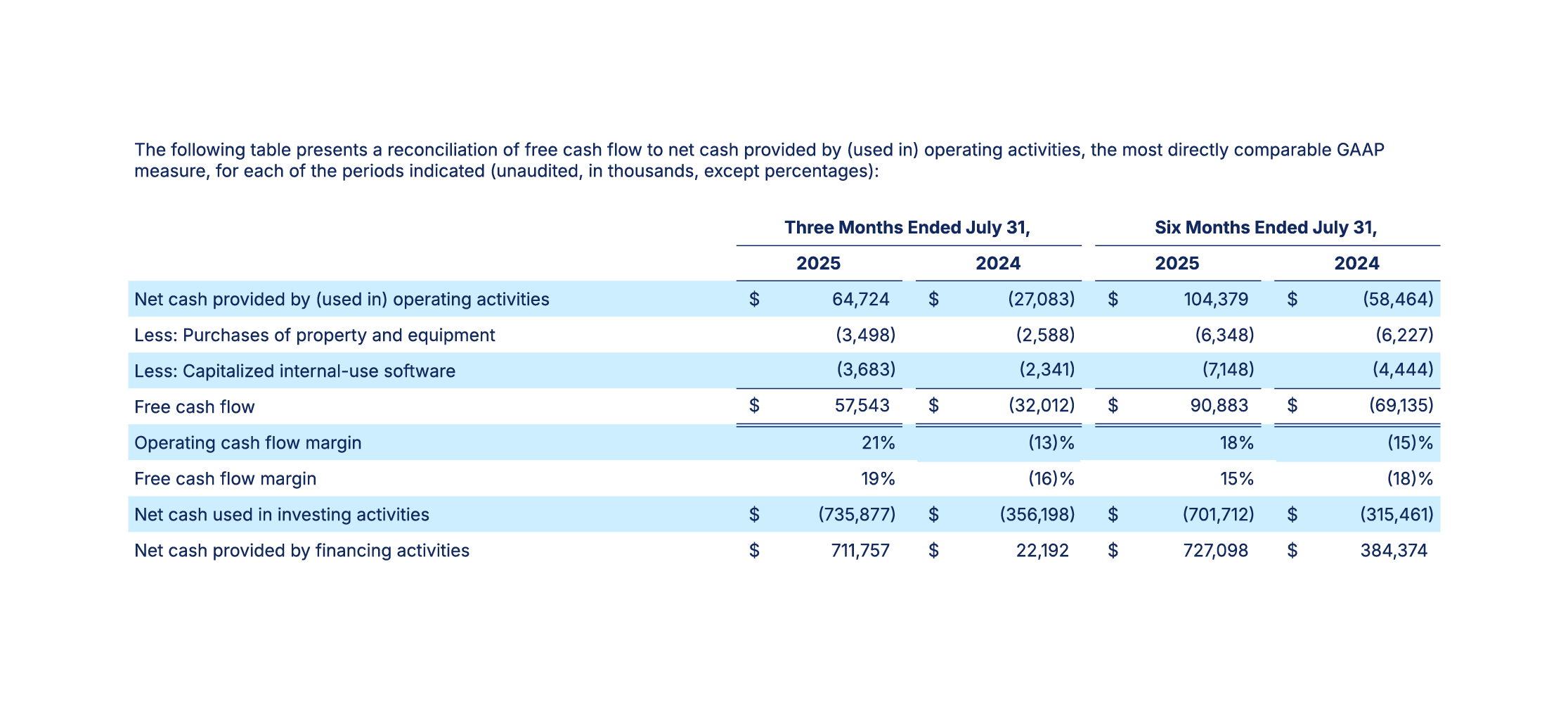

- Cash Flow from Operations: Cash flow from operations was $64.7 million, compared to $(27.1) million in the second quarter of fiscal 2025. Free cash flow was $57.5 million, compared to $(32.0) million in the second quarter of fiscal 2025.

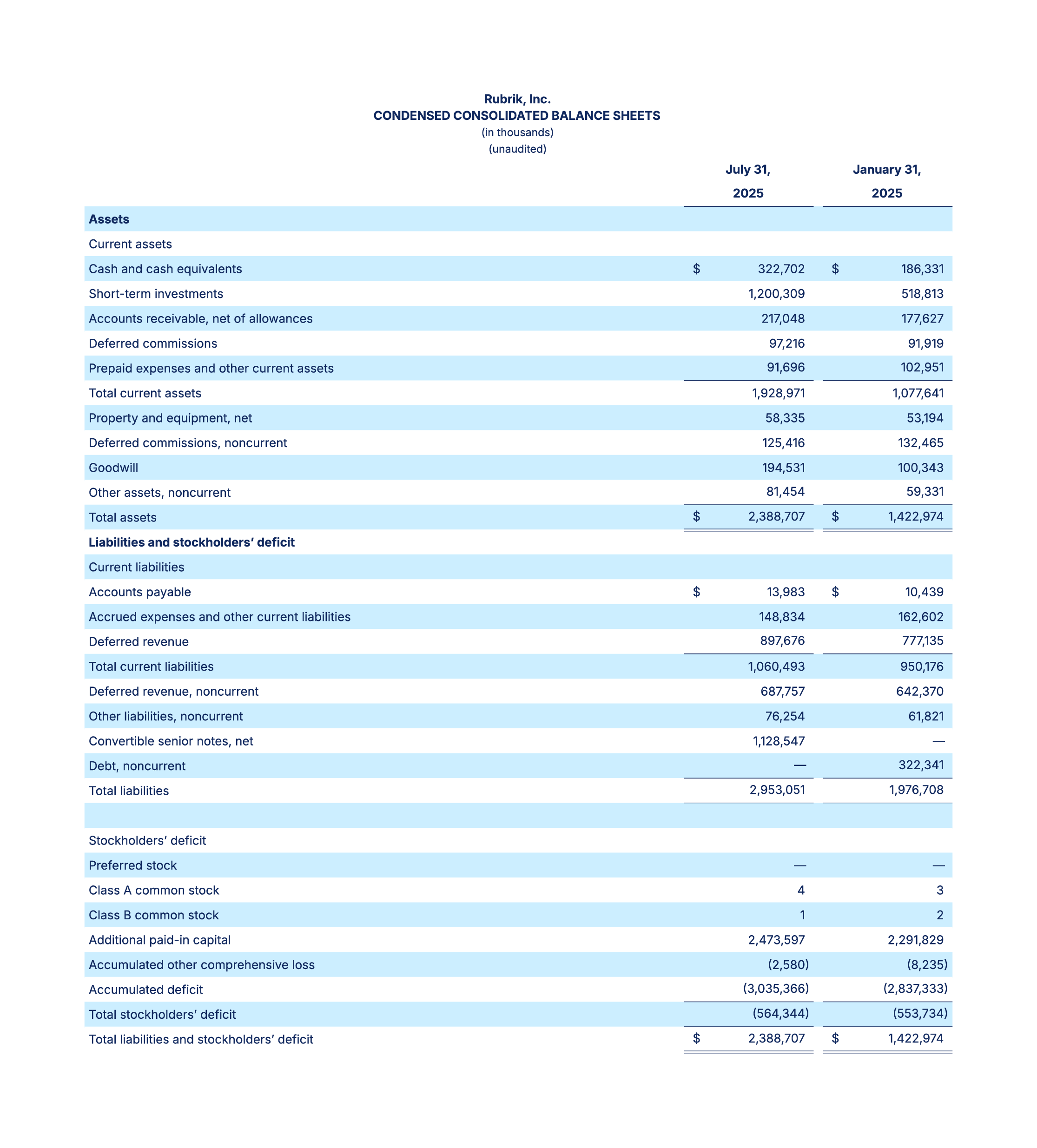

- Cash, Cash Equivalents, and Short-Term Investments: Cash, cash equivalents, and short-term investments were $1,523.0 million as of July 31, 2025.

Recent Business Highlights

- As of July 31, 2025, Rubrik had 2,505 customers with Subscription ARR of $100,000 or more, up 27% year-over-year.

- Acquired Predibase to accelerate agentic AI adoption from pilot to production at scale. Predibase accelerates production-ready AI by giving organizations an easy-to-use platform to tune models to their own data and run on an optimized inference stack. Together, Predibase and Rubrik will deliver radical simplicity in models and data, resulting in improved accuracy, lower costs, better performance, and automated data governance.

- Announced the launch of Agent Rewind, powered by Predibase’s AI infrastructure. Agent Rewind is designed to enable organizations to undo mistakes made by agentic AI by tracking agent actions and undoing changes to applications and data.

- Announced expanded immutability for Amazon RDS for PostgreSQL and comprehensive protection for Amazon DynamoDB, strengthening Rubrik’s leadership in cloud data protection.

- Named a Leader and the furthest in Completeness of Vision in the 2025 Gartner® Magic Quadrant™ for Enterprise Backup and Recovery Software Solutions for the 6th consecutive year.

Third Quarter and Fiscal Year 2026 Outlook

Rubrik is providing the following guidance for the third quarter of fiscal year 2026 and the full fiscal year 2026:

- Third Quarter Fiscal 2026 Outlook:

- Revenue of $319 million to $321 million.

- Non-GAAP subscription ARR contribution margin of approximately 6.5%.

- Non-GAAP net loss per share of $(0.18) to $(0.16).

- Weighted-average shares outstanding of approximately 200 million.

- Full Year 2026 Outlook:

- Subscription ARR between $1,408 million and $1,416 million.

- Revenue of $1,227 million to $1,237 million.

- Non-GAAP subscription ARR contribution margin of approximately 7.0%.

- Non-GAAP net loss per share of $(0.50) to $(0.44).

- Weighted-average shares outstanding of approximately 197 million.

- Free cash flow of $145 million to $155 million.

Additional information on Rubrik’s reported results, including a reconciliation of the non-GAAP results to their most comparable GAAP measures, is included in the financial tables below. A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty of expenses that may be incurred in the future, although it is important to note that these factors could be material to Rubrik’s results computed in accordance with GAAP. For example, stock-based compensation-related charges, including employer payroll tax-related items on employee stock transactions, are impacted by the timing of employee stock transactions, the future fair market value of Rubrik’s Class A common stock, and Rubrik’s future hiring and retention needs, all of which are difficult to predict and subject to constant change.

Conference Call Information

Rubrik will host a conference call to discuss results for the second quarter of fiscal year 2026, as well as its financial outlook for the third quarter of fiscal year 2026 and full fiscal year 2026 today at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time. Open to the public, analysts and investors may access the webcast, results press release, and investor presentation on Rubrik’s investor relations website at https://ir.rubrik.com. A replay of the webcast will also be accessible from Rubrik’s investor relations website a few hours after the conclusion of the live event.

Rubrik uses its investor relations website and may use certain social media accounts including X (formerly Twitter) (@rubrikInc and @bipulsinha) and LinkedIn (www.linkedin.com/company/rubrik-inc and www.linkedin.com/in/bipulsinha) as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Forward-Looking Statements

This press release and the related conference call contain express and implied “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding Rubrik’s financial outlook for the third quarter of fiscal year 2026 and full fiscal year 2026, the benefits of the Predibase acquisition, Rubrik’s market position, market opportunities, and growth strategy, product initiatives, go-to-market motions and market trends. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “will,” “would,” “should,” “could,” “can,” “predict,” “potential,” “target,” “explore,” “continue,” “outlook,” “guidance,” or the negative of these terms, where applicable, and similar expressions intended to identify forward-looking statements. By their nature, these statements are subject to numerous uncertainties and risks, including factors beyond Rubrik’s control, that could cause actual results, performance or achievement to differ materially and adversely from those anticipated or implied in the statements. Risks include but are not limited to Rubrik’s limited operating history, the growth rate of the market in which Rubrik competes, Rubrik’s ability to effectively manage and sustain its growth, Rubrik’s ability to introduce new products on top of its platform, Rubrik’s ability to compete with existing competitors and new market entrants, Rubrik’s ability to expand internationally, its ability to utilize AI successfully in its current and future products, and Rubrik’s ability to successfully integrate Predibase into its operations and market the Predibase platform. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the caption “Risk Factors” and elsewhere in our most recent filings with the Securities and Exchange Commission, including in our Quarterly Report on Form 10-Q for the quarter ended July 31, 2025. Forward-looking statements speak only as of the date the statements are made and are based on information available to Rubrik at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. Rubrik assumes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, except as required by law.

Non-GAAP Financial Measures

Rubrik has provided in this press release financial information that has not been prepared in accordance with GAAP. Rubrik uses these non-GAAP financial measures internally in analyzing its financial results and believes that use of these non-GAAP financial measures is useful to investors as an additional tool to evaluate ongoing operating results and trends and in comparing Rubrik’s financial results with other companies in its industry, many of which present similar non-GAAP financial measures.

Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with Rubrik’s condensed consolidated financial statements prepared in accordance with GAAP. A reconciliation of Rubrik’s historical non-GAAP financial measures to the most directly comparable GAAP measures has been provided in the financial statement tables included in this press release, and investors are encouraged to review the reconciliation.

Free Cash Flow. Rubrik defines free cash flow as net cash provided by (used in) operating activities less cash used for purchases of property and equipment and capitalized internal-use software. Rubrik believes free cash flow is a helpful indicator of liquidity that provides information to management and investors about the amount of cash generated or used by Rubrik’s operations that, after the investments in property and equipment and capitalized internal-use software, can be used for strategic initiatives, including investing in Rubrik’s business and strengthening its financial position. One limitation of free cash flow is that it does not reflect Rubrik’s future contractual commitments. Additionally, free cash flow is not a substitute for cash used in operating activities and the utility of free cash flow as a measure of Rubrik’s liquidity is further limited as it does not represent the total increase or decrease in Rubrik’s cash balance for a given period.

Non-GAAP Subscription Cost of Revenue. Rubrik defines non-GAAP subscription cost of revenue as subscription cost of revenue, adjusted for amortization of acquired intangibles, stock-based compensation expense, stock-based compensation from amortization of capitalized internal-use software, and other non-recurring items.

Non-GAAP Operating Expenses (Research and Development, Sales and Marketing, General and Administrative). Rubrik defines non-GAAP operating expenses as operating expenses (research and development, sales and marketing, general and administrative), adjusted for, as applicable, stock-based compensation expense, and other non-recurring items.

Non-GAAP Gross Profit, Non-GAAP Operating Loss, and Non-GAAP Net Loss. Rubrik defines non-GAAP gross profit, non-GAAP operating loss, and non-GAAP net loss as the respective GAAP measure, adjusted for amortization of acquired intangibles, stock-based compensation expense, stock-based compensation from amortization of capitalized internal-use software, other non-recurring items, and the related income tax effect of these adjustments.

Non-GAAP Gross Margin. Rubrik defines non-GAAP gross margin as non-GAAP gross profit as a percentage of total revenue.

Non-GAAP Net Loss Per Share, Basic and Diluted. Rubrik defines non-GAAP net loss per share, basic and diluted as non-GAAP net loss divided by the weighted-average number of shares of common stock outstanding during the period.

Free Cash Flow and Free Cash Flow Margin. Rubrik defines free cash flow as net cash provided by (used in) operating activities less cash used for purchases of property and equipment and capitalized internal-use software. Free cash flow margin is calculated as free cash flow divided by total revenue.

Subscription Annual Recurring Revenue (“ARR”) Contribution Margin. Rubrik defines Subscription ARR Contribution Margin as Subscription ARR contribution divided by Subscription ARR at the end of the period. Rubrik defines Subscription ARR Contribution as Subscription ARR at the end of the period less: (i) non-GAAP subscription cost of revenue and (ii) non-GAAP operating expenses for the prior 12-month period ending on that date. Rubrik believes that Subscription ARR Contribution Margin is a helpful indicator of operating leverage. One limitation of Subscription ARR Contribution Margin is that the factors that impact Subscription ARR will vary from those that impact subscription revenue and, as such, may not provide an accurate indication of Rubrik’s actual or future GAAP results. Additionally, the historical expenses in this calculation may not accurately reflect the costs associated with future commitments.

Key Business Metrics

Subscription ARR. Rubrik calculates Subscription ARR as the annualized value of our active subscription contracts as of the measurement date, based on our customers’ total contract value, and assuming any contract that expires during the next 12 months is renewed on existing terms. Subscription contracts include offerings for our Rubrik Security Cloud (“RSC”) platform and related data security SaaS solutions, term-based licenses for our RSC-Private platform and related products, prior sales of CDM sold as a subscription term-based license with associated support, and standalone sales of Rubrik’s SaaS subscription products like Anomaly Detection and Sensitive Data Monitoring.

Cloud ARR. Rubrik calculates Cloud ARR as the annualized value of its active cloud-based subscription contracts as of the measurement date, based on Rubrik’s customers’ total contract value, and assuming any contract that expires during the next 12 months is renewed on existing terms. Rubrik’s cloud-based subscription contracts include RSC and RSC-Government (excluding RSC-Private). Cloud ARR also includes SaaS subscription products like Anomaly Detection and Sensitive Data Monitoring.

Average Subscription Dollar-Based Net Retention Rate. Rubrik calculates Average Subscription Dollar-Based Net Retention Rate by first identifying subscription customers (“Prior Period Subscription Customers”) which were subscription customers at the end of a particular quarter (the “Prior Period”). Rubrik then calculates the Subscription ARR from these Prior Period Subscription Customers at the end of the same quarter of the subsequent year (the “Current Period”). This calculation captures upsells, contraction, and attrition since the Prior Period. Rubrik then divides total Current Period Subscription ARR by the total Prior Period Subscription ARR for Prior Period Subscription Customers. Rubrik’s Average Subscription Dollar-Based Net Retention Rate in a particular quarter is obtained by averaging the result from that particular quarter with the corresponding results from each of the prior three quarters.

Customers with $100K or More in Subscription ARR. Customers with $100K or more in Subscription ARR represent the number of customers that contributed $100,000 or more in Subscription ARR as of period end.

Gartner disclaimer

Gartner, Magic Quadrant for Enterprise Backup and Recovery Software Solutions, Michael Hoeck, et al, 24 June 2025.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

About Rubrik

Rubrik (NYSE: RBRK) the Security and AI company, operates at the intersection of data protection, cyber resilience and enterprise AI acceleration. The Rubrik Security Cloud platform is designed to deliver robust cyber resilience and recovery including identity resilience to ensure continuous business operations, all on top of secure metadata and data lake. Rubrik’s offerings also include Predibase to help further secure and deploy GenAI while delivering exceptional accuracy and efficiency for agentic applications.

Investor Relations Contact

Melissa Franchi

VP, Head of Investor Relations, Rubrik

781.367.0733

IR@rubrik.com

Public Relations Contact

Jessica Moore

VP, Global Communications, Rubrik

415.244.6565

jessica.moore@rubrik.com