customer stories

Trusted by World Leading Brands for Cyber Resilience

Value Delivered

Securing the world's data

See how organizations around the world use Rubrik Security Cloud for cyber resilience.

The undisputed leader

in data security

"Rubrik is our insurance policy for our data. How do you quantify peace of mind? It's priceless."

Dan Gallivan, Director of IT, Payette

What our customers are saying on Gartner

Resources & Insights

Complete Cyber Resilience

Rubrik Security Cloud helps protect your data, monitor data risk, and recover your data and applications so you can keep your business moving forward.

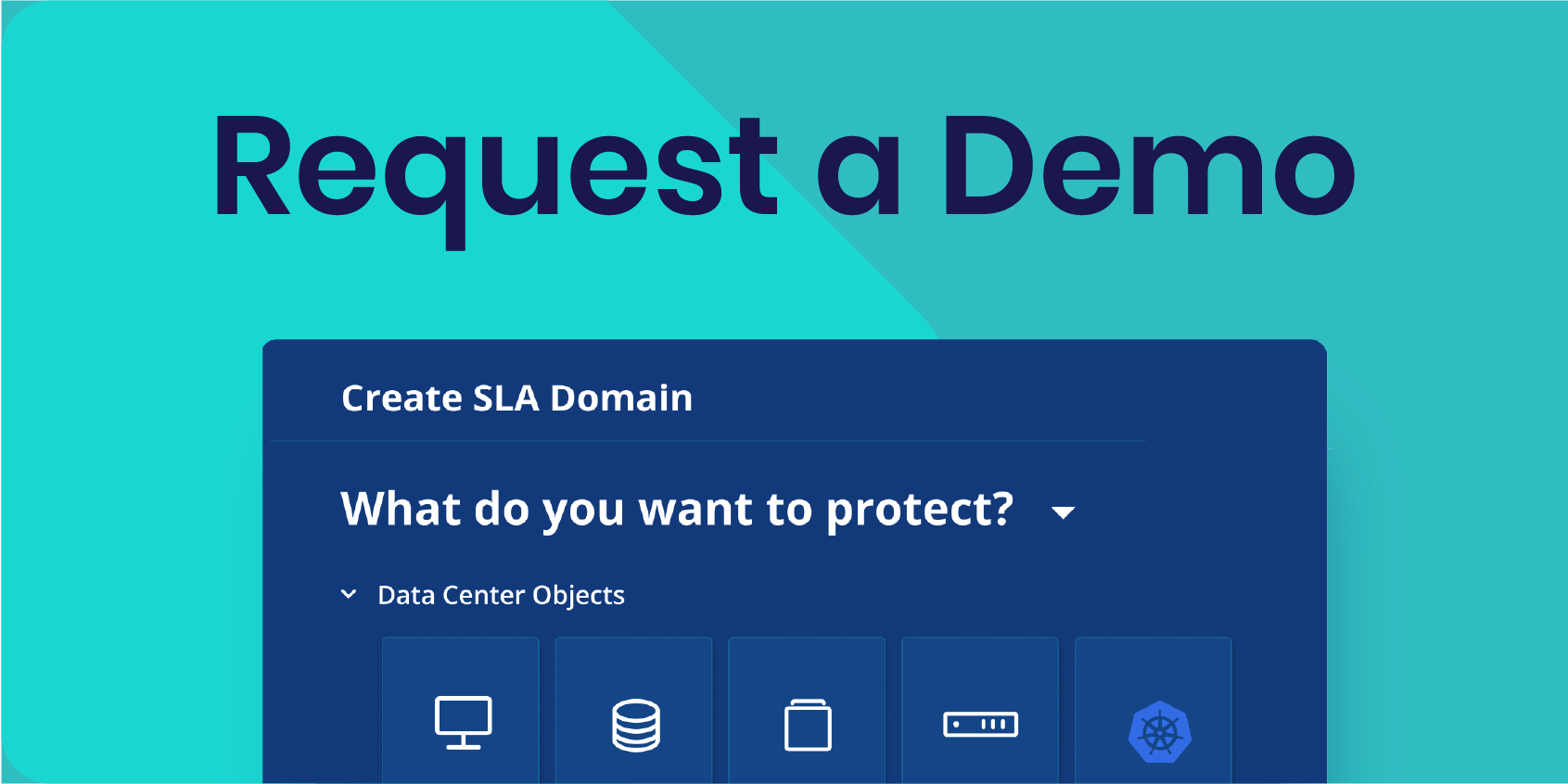

Ready to get started?

Get a personalized demo of the Rubrik Zero Trust Data Security platform.